Online Pautang with Digido: Mabilis na pagutang hanggang sa 10000 online. Ang mga pautang sa online na hatid ng Digido ay mabilis at maaasahan upang matugunan ang inyong pangangailangan. Get emergency loans for bills payment and business capital in 5 mins.

| Pautang | Digodo (old: Robocash) |

| Amounts | ₱10 500 – ₱ 25 000 |

| Terms | 3 – 6 na buwan |

| Mag-Apply | PAGKUHA NG LOAN DIGIDO |

Up to PHP 25 000 for up to 180 days for repeated loans. Kami ay nag aalok ng madali at mabilis na Loan online. Ang Digido ay magbibigay ng halaga ng loan sa ilang minuto lamang. Ang loan ay awtomatikong ibinibigay.

What is Online Pautang Digido?

Digido is a legit and state-licensed online lender. Digido stands out from its competitors with a fully automated online portal and highly innovative, customer-friendly financial solutions. Their automated loan lending system makes independent decisions based on each application and transfers money within a few hours.

They provide a wide range of loans from 0% interest promotional loans to non-collateral loans of up to PHP 25,000. As a licensed lender, they adhere to the lending rules and regulations without any compromise. They do not inflate the interest rates to cover the risks of a borrower with bad credit history. Similarly, they don’t indulge in unethical practices such as hidden charges or asking for upfront commissions to exploit the applicant’s vulnerable position.

Digido realizes that not everybody can make loan applications through their online platform or their mobile application. Their banking professionals, with their customer-friendly approach and domain expertise, help such people secure the right loans without any confusion or inconveniences. You can choose your own option to make a loan – come to their office or make a loan on the website.

Online Loans in the Philippines

Irrespective of age, gender, occupation or nationality, people strive hard to achieve financial independence. For many, the conventional teaching of “Spend less, avoid loans, save more” is the gospel words of financial management.

The misconception of loans as evil forces makes people avoid loans as far as possible with the fear of getting into debt. Their cold shoulder approach for loans, even under extreme financial stress, can deteriorate the quality of life quite miserably.

But in reality, loans can be your best buddies in improving your financial health in different ways.

For instance, a loan to upgrade your work productivity or for securing a new skill will fetch dividends in the long run. But if you take loans to satisfy your shopping addiction or for entertainment, it will damage your financial stability for sure.

So it is not loans, but the ways you use them that make the difference.

What are Online Loans?

Whatever your earning level is, a proper financial plan alone can make you a financially independent person. Still, an unexpected requirement for money can ruin your plans. To tide over such situations, you may have to depend on loans from friends, relatives, banks, or lenders.

Traditionally banks are the best option for any loan due to their low-interest rates and more flexible loan conditions. But the requirements for a broad set of documents, good credit score, and lengthy approval time are some of the valid reasons for a borrower to turn away from banks and look for alternatives, mainly lenders. When an emergency strikes, not everybody has time to visit different lenders or bank branches and compare the loan terms. As an alternative, banks and various financial institutions offer loan processing through an online interface, known as “Online Loans”.

Online loans give a slew of irresistible features for a prospective borrower:

- One can easily compare the loan terms from different lenders from his or her computer or smartphone without leaving the home or office.

- Online lenders operate 24/7 enabling one to secure a loan while traveling or at the wee hours without bothering about off days or weekends.

- Typically online loans are unsecured loans with minimal documentation requirements. These loans don’t require collateral, guarantor, or excellent credit score.

- An automated system performs loan evaluation, decision-making, and transfer of funds in a completely unbiased and instantaneous way.

- There is no need to disclose your financial details to the banking professional, and it assures the confidentiality of your sensitive data.

- The entire process of loan application and disbursal happens within a few hours. Hence, online loans are known as Single Day Loans.

- The loan approval rate for online loans is as high as 90%.

- Online lenders do not perform cross-selling of products, as in the case of banks.

- Online loans are generic loans, which means one can use it for any purpose.

- Tracking of your loans and their payment are quite easy on an online loan.

Minimal documentation, high loan approval rate, and immediate fund availability, even for people with lousy credit history, make online loans the most popular type of loans for the Filipinos.

How do Instant Loans Work in the Philippines?

In the Philippines, the distribution of banks is quite scattered, especially in the non-metro regions. It keeps nearly 70% of the population of the Philippines beyond the ambit of formal banking services.

It creates a double whammy effect. The majority of the non-urban population has to travel to remote cities to get a banking service. The massive influx of customers makes the banks overcrowded, and you have to spend considerable time in the queue to get things done. Along with the tedious documentation process, it makes loans from banks an unhappy endeavor for the majority.

On the other hand, for most of the online loans, what you need is just a valid ID card and income proof. The loan application and approval process are straightforward, and anyone with Internet access can get a loan instantly.

The very first step for an online loan is creating a user account on the portal. A user can apply for a loan from his or her account and upload the necessary documents to prove the creditworthiness. The system will evaluate the application and will give you a decision within a few minutes. Once the loan agreement is approved, you will receive the money in the specified account within a few hours.

For repeat borrowers with no pending loans, the documentation part is often omitted for the second loan. The Internet penetration of the Philippines is high. So when an urgent financial requirement such as a medical emergency or vehicle repairing hits, any Filipino’s first choice would be an online loan rather than a brick-and-mortar bank in a distant location.

What is the Best Loan App in the Philippines?

The ever increasing netizens of the Philippines use smartphones as their primary device for Internet connectivity. Digido mobile App is well optimized and loaded with features. It helps the Internet-savvy Filipinos enjoy the benefits of online lending in a seamless way. If you want to skip a long line in the banks and just apply for an online loan through your phone, we suggest that you download the Digido for Android or Apple mobile application and appreciate its convenience. The application is highly evaluated by users and has many positive feedback from those who have already received money with its help.

Are Online Loans Legit?

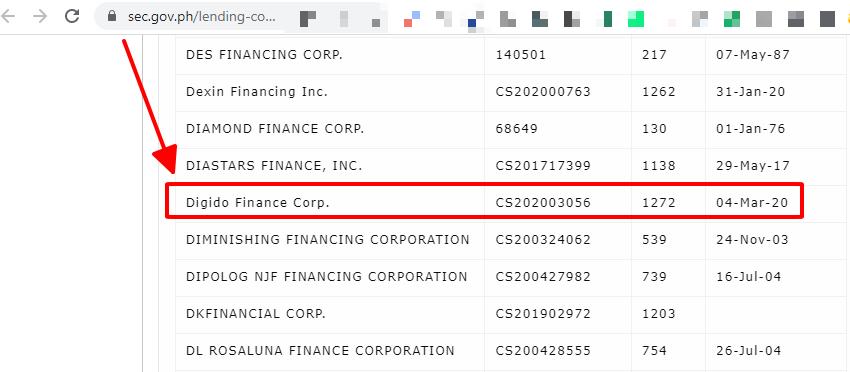

Not all online money lending companies are legit. Online lending companies that operate legally have to register its existence under SEC. They should have a physical office set up within the Philippines so that the enforcement authorities can track them down in case of any untoward incidents.

Still, several illegal lenders operate only in the online world. They do not follow the regulation and loot the customers through various unethical practices.

For a borrower who seeks instant loans online, differentiating such lenders from legally operating ones is a bit difficult task. While applying for an instant money loan online, always ensure that the lender is legit by checking the details on the website: https://www.sec.gov.ph/.

For example, Digido is a fully legal company, it has SEC Registration No.: 202003056, and Certificate of Authority No. 1272. Any client can check this information on the state website in the list of financial companies.

How to Take an Instant Loan Correctly and Profitably?

The ability to borrow money online instantly without any complex documentation process is highly tempting. People may use these loans for every financial need without any contemplation. Such an approach could spoil their financial discipline and push them to debts.

Below are the crucial points in securing the right loan:

- Always provide accurate information. If you hide your previous loan history, the lender may perform hard checks. It will reduce your credit score and affect your ability to secure a better loan.

- Do not apply for loans with multiple lenders at the same time. Each one will perform credit checks, and it will pull down your credit score significantly.

- Compare loans with different lenders and choose the best option.

- Ensure that you are able to repay the loan completely within the stipulated time. Any deviation from this can affect your credit score and will danger your ability to secure good loans.

- Before accepting any loans, read and understand the loan documents and conditions thoroughly.

Faq Online Pautang Digido

Digido Online Loan Requirements

Any Filippino citizen within the age group of 21-70 years, with a working mobile connection, may apply for a loan with Digido. The applicant has to submit a government-issued identity card. Inclusion of documents such as payslips, COE, ITR, company ID, DTI (if self-employed or with business) along with the loan application will increase your chances of loan approval.

Can I pay installment in Digido?

Digido also supports monthly installment loans with a term of 3 • 4 • 5 • 6 months with an amount of 1,000 – 25,000 with a very favorable interest rate.

Advantages of Digido Loans

Some of the attributes of Digido loans are the following:

- No hidden charges, upfront fees, or commissions;

- They are open 24/7 without any holidays or weekends;

- Easy loan application process and instantaneous decisions;

- Multiple modes of loan application: Web, Mobile App and through branches;

- A loan approval rate of more than 90%;

- Loans for any purpose;

- Online loan calculator to choose the right loan amount and duration;

- Loans without any collateral and guarantors;

- Better loans for repeat buyers;

- Loans even without bank accounts;

- Multiple Loan Repayment Options – bank transfer, remittance centre, 7-Eleven, offline branches, Dragonpay.

Digido First Loan with no Interest

Digido offers loans of PHP 1,000-30,000 with no interest on the first loan for seven days. The only requirement is proof of identity and income. The availability of quick loans with no interest is a great help for those who just started earning and is building a credit history. The loan eliminates the over-dependence on loan sharks to overcome the initial financial obligations and improves the borrower’s possibilities for a better loan in the future.

An Example of the Interest Rate Calculation Digido

Each one has different requirements for the loan amount and loan duration. Our online loan calculator is an exceptional tool that shows the exact repayment amount for each combination of loan amount and loan term. Let’s look at a sample calculation.

The maximum annual loan rate is 143%. Take the amount of PHP 20,000 and a period of 6 months.

In this case, your monthly payment will be only PHP 5,000, and the total cost of interest will be 2,383 pesos monthly.

The availability of a loan calculator in the Philippines helps the Filipino have a clear idea about the optimal loan amount, term, and repayment before subscribing to any loans.

Conclusion

Loans are just another financial product. It alone won’t do any harm. But if you cannot set your priorities right and do not follow a financial strategy, a loan can be problematic. As long as you make a clear judgment about your financial needs and follow the plan, loans can be a great tool to reach financial independence.

|

Pros

|

Cons

|

Contact DIGIDO

| Company | Digido Finance Corp. |

| Numero ng telepono | (02) 8876-84-84 (Mula 8am hanggang 5pm araw-araw) |

| Website | https://digido.ph |

| support[@]digido.ph | |

| https://www.facebook.com/digido.ph | |

| https://www.instagram.com/digido.philippines/ |

DIGIDO FINANCE CORP. UNIT 2/C, Murphy Center, 187 Bonny Serrano Road, Socorro, QUEZON CITY SECOND DISTRICT, NCR, Philippines 1109.