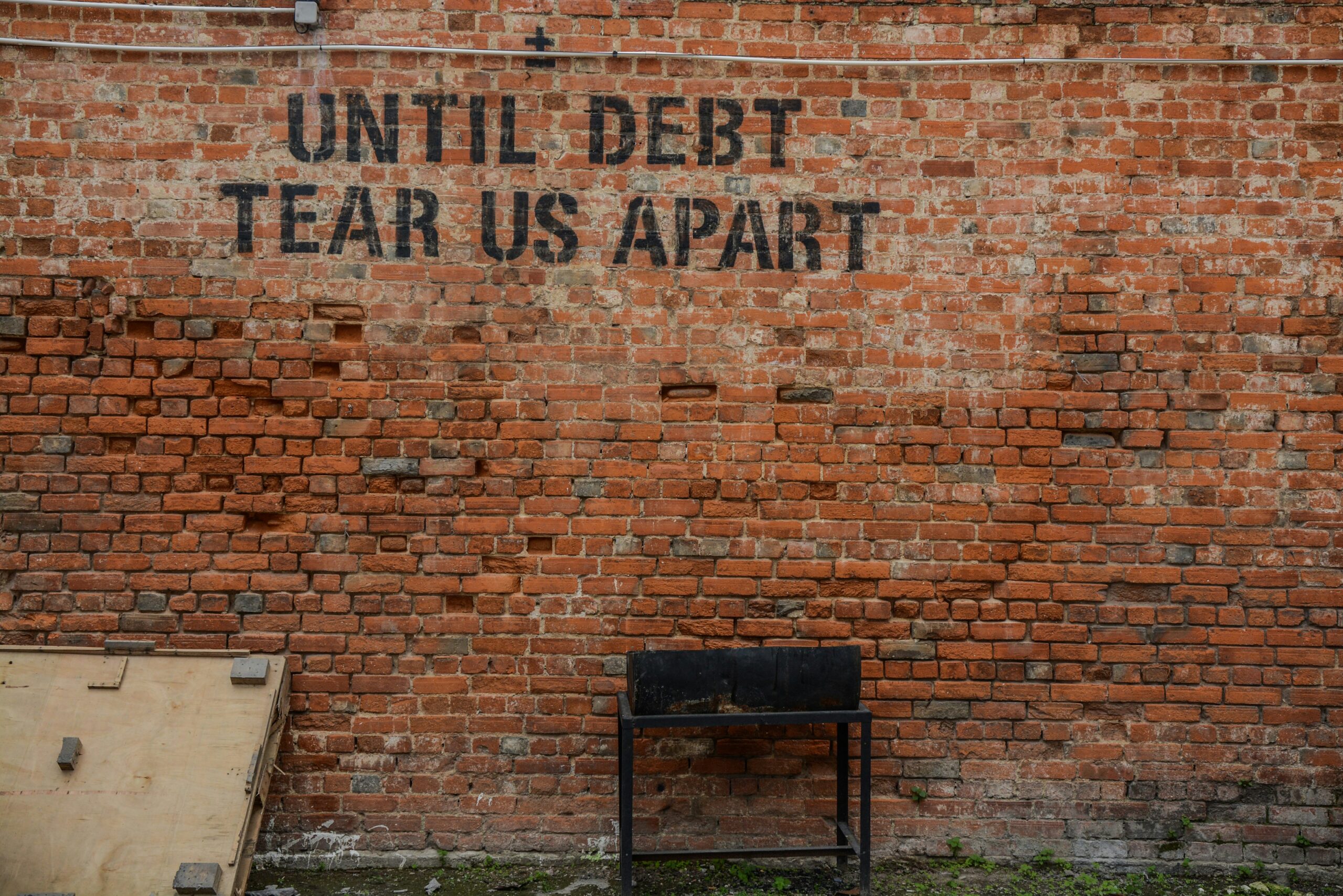

Debt can be a burden that weighs heavily on anyone’s shoulders. Whether it’s credit card bills, personal loans, or other financial obligations, managing multiple debts can be overwhelming. This is where debt consolidation comes in. Debt consolidation is a financial strategy that allows individuals to combine multiple debts into a single loan, making it easier to manage and pay off.

Compare and Apply Online Loans in 2 Minutes – Online Legit Loans in the Philippines

Get a cash loan online with OnlinePautang! Our steps are quick and easy. Loan up to P25K. Once approved, get funds in minutes. Apply today!

| Loan Provider | Loan Details | Apply |

|---|---|---|

| Digido Loan |

Fast loans up to 10,000 PHP (first loan), up to 25,000 PHP (second loan). |

APPLY NOW |

| MoneyCat Loan | 0% interest on your FIRST loan. | APPLY NOW |

| Crezu Loan | Fast online loans in Philippines, 1st credit with 0%. | APPLY NOW |

| Credify Loan | First loan up to 4,000 PHP with 0% interest in 15 minutes. | APPLY NOW |

| SOSCredit |

Loans online Philippines to new clients up to 7,000 PHP without interest. |

APPLY NOW |

| Online Loans Pilipinas |

First loan 0% interest up to 7,000 PHP, amount: 1,000 PHP – 20,000 PHP, age: 22 – 70, term: 7 days – 30 days. |

APPLY NOW |

| Mazilla Loan Website |

Loan period: 91 days – 2 years, annual interest rate: 30% – 365%. |

APPLY NOW |

| Binixo Loan PH |

First loan possible from 1,000 to 25,000 PHP with a commission fee of 0.01% if repaid on time. |

APPLY NOW |

| Finbro Loan PH | Instant online loans up to 50,000 PHP in Philippines. | APPLY NOW |

| Kviku Loan PH | Fast loans all over the Philippines within 24 hours. | APPLY NOW |

| Zaimoo Loan PH | Borrow up to 25,000 pesos at 0.01% interest today. | APPLY NOW |

| CashXpress PH | Providing loans up to 20,000 PHP. | APPLY NOW |

| PesoRedee PH |

Apply now and get approved within 24 hours, no collaterals, no tedious processing. |

APPLY NOW |

| Finami PH | Fast and easy online loans 24/7. | APPLY NOW |

| Tonik Bank Loan | Apply for a loan up to P50,000 in 30 minutes with Tonik. | APPLY NOW |

How Does Debt Consolidation Work?

Debt consolidation works by taking out a new loan to pay off existing debts. This new loan typically has a lower interest rate and more favorable terms, making it easier for individuals to repay their debts. By consolidating multiple debts into one, individuals can simplify their repayment process and potentially save money on interest payments.

There are different ways to consolidate debt in the Philippines. One option is to apply for a personal loan from a bank or financial institution. This loan can be used to pay off existing debts, leaving individuals with just one loan to manage. Another option is to use a balance transfer credit card, which allows individuals to transfer their existing credit card balances to a new card with a lower interest rate.

The Benefits of Debt Consolidation

Debt consolidation offers several benefits for individuals struggling with multiple debts. Here are some of the key advantages:

1. Simplified Repayment

One of the main advantages of debt consolidation is that it simplifies the repayment process. Instead of keeping track of multiple due dates and payment amounts, individuals only need to make one payment towards their consolidated loan. This can help reduce the risk of missing payments and incurring late fees.

2. Lower Interest Rates

Debt consolidation often allows individuals to secure a lower interest rate on their new loan. This can result in significant savings over time, especially if the previous debts had high interest rates. By paying less in interest, individuals can allocate more funds towards paying off the principal balance of their debt.

3. Improved Credit Score

Consolidating debt can also have a positive impact on an individual’s credit score. By paying off multiple debts and managing a single loan responsibly, individuals can demonstrate their ability to handle credit effectively. This can lead to an improved credit score over time, making it easier to access future credit at favorable terms.

4. Debt Repayment Plan

When individuals consolidate their debts, they often work with a financial advisor or credit counselor to create a debt repayment plan. This plan helps individuals stay on track and provides a clear roadmap for becoming debt-free. It can also provide valuable guidance on managing finances and avoiding future debt problems.

Is Debt Consolidation Right for You?

While debt consolidation offers many benefits, it may not be the right solution for everyone. It’s important to carefully consider your financial situation and goals before deciding to consolidate your debts. Here are a few factors to consider:

1. Interest Rates

Compare the interest rates on your existing debts with the interest rate on the consolidation loan. If the new loan has a significantly lower interest rate, debt consolidation may be a good option for you.

2. Financial Discipline

Debt consolidation requires financial discipline to avoid accumulating new debts while repaying the consolidated loan. If you’re confident in your ability to manage your finances responsibly, debt consolidation can be an effective strategy.

3. Long-Term Financial Goals

Consider your long-term financial goals and how debt consolidation fits into your plans. If becoming debt-free is a priority and debt consolidation helps you achieve that goal faster, it may be the right choice for you.

Conclusion

Debt consolidation can be a valuable tool for individuals looking to simplify their debt repayment and save money on interest payments. By consolidating multiple debts into one, individuals can regain control of their finances and work towards becoming debt-free. However, it’s important to carefully consider your financial situation and goals before deciding if debt consolidation is the right option for you.